RIYADH, the Saudi capital, is no easy place to navigate. It sprawls over 1,500 square kilometres (580 square miles) and, but for a few exceptions, its drab, low-rise buildings all look much the same. For most of the year it is far too hot and dusty to walk anywhere. Little wonder the kingdom is touting a new 85-station metro, which is due to open in 2018, as a revolution for the city (it is expected that women will travel in separate carriages).

Public-transport systems are in vogue across the region. Doha, the capital of tiny Qatar, will open its metro a year after Saudi Arabia. Oman is building railways. And it is not just the Gulf: Algeria is also constructing railways. Morocco is interested in trams. Lebanon is looking into a rapid bus system—a bus and metro hybrid with its own lanes—for the areas around Beirut.

-

Monarch Airlines goes into administration

-

China is turning against cryptocurrencies

-

The Tory conference reflects the dismal state of the party

-

At least 58 people are killed and 515 injured in a shooting in Las Vegas

-

A Nobel prize for medicine for the understanding of body clocks

-

Why Swedish troops just finished their biggest war games in 23 years

This trend is relatively new. Many Middle Eastern countries started to invest in buses only around a decade ago, but public networks are still limited; private minibuses abound. Dubai was the first place to operate a mass transit system when it opened its metro in 2009. In the few countries with railways, they are often out of use. Instead, governments have tended to build new roads. Amman and Beirut have no transport other than buses. Metro systems in Cairo and Tehran have failed to keep pace with urban expansion. Mostly, public transport in the region remains “really very bad”, says Ziad Nakat of the World Bank.

Demand for ways to get around has grown rapidly since the 1970s. Populations have exploded. The region is one of the most urbanised in the world: some 60% of Middle Eastern people live in cities. Poor urban planning means towns often sprawl in every direction. Greater Cairo boasts a population of some 20m people.

The lack of good public transport, coupled with rising incomes in some places, has pushed up the use of cars. Pew, an American research outfit, reckons 81% of Lebanese households have a car, not far off America’s 88%. Between 2012 and 2022, car ownership in the region is set to grow more quickly than any other, according to Carmudi, a car classifieds site. Meanwhile in poorer countries, such as Egypt, where cars are beyond measly pay packets, people struggle to get from A to B. Donkeys and carts endure. Tuk-tuks ply the streets in shanty towns and rural areas. People hang out of minibuses or are forced to squash up, faces against windows.

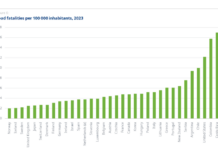

The ensuing mess makes for nasty air and grumpy people, not to mention some of the world’s highest rates of road fatalities. A World Bank study estimated (conservatively) that 4% of Egypt’s GDP was lost each year because of time wasted in traffic in Cairo, its capital and the Arab world’s megacity. Part of the reason is that tailbacks encourage people to move into cities rather than commute. This adds to the stresses on cities already struggling to provide services to their people, such as Beirut, whose 2m inhabitants do not receive 24-hour power and water.

The old solution of simply building more roads is unsustainable. For one thing, land has become too expensive to tarmac over. But shiny buses and trains—one of Riyadh’s stations is being designed by the architect Zaha Hadid—will not be enough on their own, either. People must be tempted to get out of the cool comfort of their car. Many governments, from Egypt to Iran, have started to remove fuel subsidies, causing the price of petrol to rise. But it is still only 20 cents per litre in Kuwait, compared with $1.40 in Britain. Road tolls, which exist in Dubai, and higher parking charges are needed across the region.

The biggest barrier to public transport, though, is the expense. Metros can cost millions of dollars per kilometre of track. At a time of low oil prices, even the oil-producing states are cutting back. The United Arab Emirates has stopped tenders for the second part of Etihad, a new 1,200km national railway that is costing 40 billion dirhams ($11 billion). But a day navigating Cairo’s roads is enough to show that inaction now will lead to higher costs in the future.